Amazing ! Why Is Credit Risk Management Important In The Financial Sector

Recent Trends in Credit Risk Management by Banks. Expand your career possibilities with the Financial Risk Management Certification.

Top 5 Risk Management Process In Banking And Financial Sector

Without proper management they realized exposure to risk.

Why is credit risk management important in the financial sector. Risk management practices within the financial sector are of particular interest to regulators. Global Concerns about Financial Risk. Use alternative credit data to evaluate credit invisibles.

Ad GARP Is the Worlds Leading Professional Organization for Risk Managers. Credit risk management is the practice of mitigating losses by understanding the adequacy of a banks capital and loan loss reserves at any given time a process that has long been a challenge for financial. Ad Leverage alternative data to make smarter lending decisions.

The first step in credit risk management is the creation of a credit policy and then a credit. Discuss why credit risk management within the financial sector is so essential. This is why its important to maintain a robust credit risk management system.

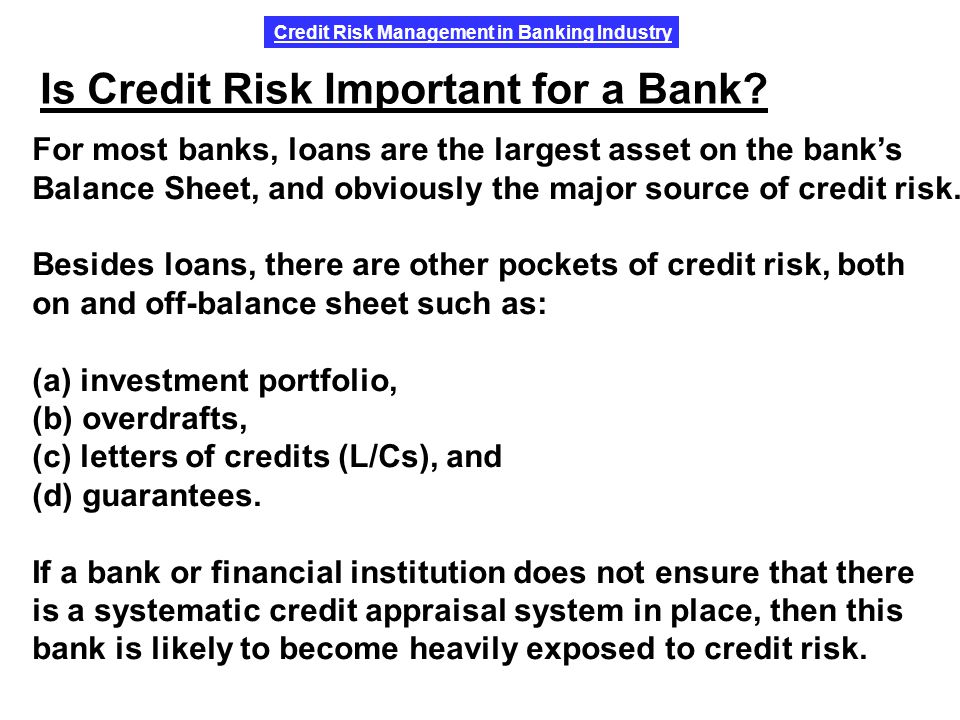

Credit risk was the possibility that a borrower of counter party would fail to meet. It is the only proven way for CFOs to see around corners. The credit risk management is undergoing an important change in the banking industry.

Ad GARP Is the Worlds Leading Professional Organization for Risk Managers. Banks have clearly indicated that centralization standardization consolidation timeliness active portfolio management and efficient tools for exposures are the key best practice in credit risk management. This is a process that has long been a challenge for financial institutions but is increasingly important.

The Importance of Credit Risk Management. Credit Risk Management Tools for Lenders With the global financial crisis still recent credit risk management is still the focus of intense regulatory scrutiny. A Framework For Understanding Credit Risk.

Since the financial collapse of 2007 when so many of the worlds largest lending institutions crumbled organizations have started recognizing the critical importance of credit risk management. Admin Posted on August 30 2020 Discuss why credit risk management within the financial sector is so essential. Ad Leverage alternative data to make smarter lending decisions.

Credit risk management on the other hand is the practice of mitigating those losses by understanding the adequacy of a borrowers capital and loan loss reserves. This is because failures within this sector disrupt the functionality of the financial. Discuss why credit risk management within the financial sector is so significant.

Credit risk refers to the probability of loss due to a borrowers failure to make payments on any type of debt. For banks and financial institutions credit risk had been an essential factor that needed to be managed well. This is because failures within this sector disrupt the functionality of the financial.

Expand your career possibilities with the Financial Risk Management Certification. While stricter credit requirements as a top-down approach have helped mitigate some economic risk it has left many companies struggling to overhaul their approach to credit risk. Use alternative credit data to evaluate credit invisibles.

Do you need help with your Discuss why credit risk management within the financial sector is so essential. Question Module 06 Written Assignment Credit Risk Management Risk management practices within the financial sector are of particular interest to regulators. Credit risk management is an important aspect.

Credit risk can not be migrated but they can be controlled and managed to a controllable level that reduces the risk exposure to lenders. According to Accentures 2019 Global Risk Management Study new risks are emerging faster than ever and are becoming even more complexDisruptive technology data breaches and operational risks are the top three challenges named by risk.

Credit Risk Risk Management Corporate Finance Institute

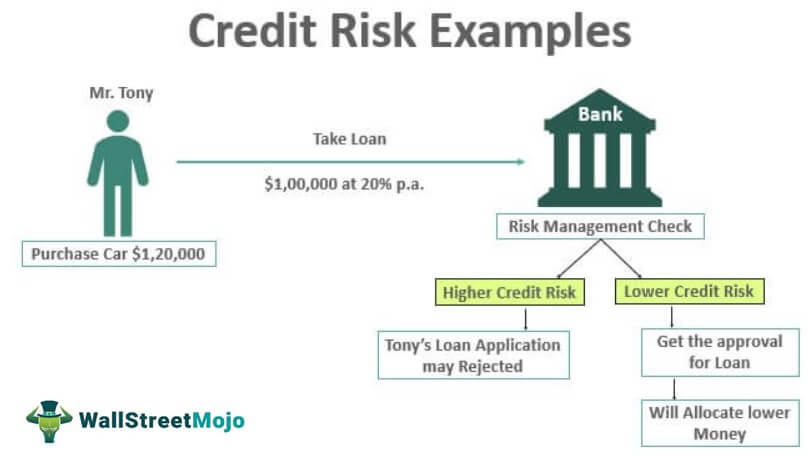

Credit Risk Examples Top 3 Examples Of Credit Risks With Explanation

4 Types Of Financial Risk Analytics Steps

Purpose Of Credit Risk Analysis Overview How It Works Drivers

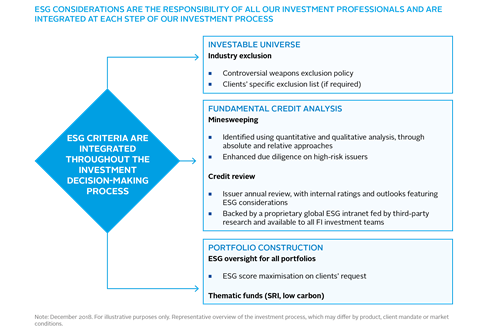

Credit Risk Case Study Hsbc Global Asset Management Case Studies Pri

Credit Risk Management Principles Tools And Techniques The Global Treasurer

Financial Risk Types Of Financial Risk Advantages And Disadvantages

Credit Risk Management Ppt Download

Credit Risks In Bank Meaning Examples Top 3 Causes With Explanation